Introduction

Crypto passive income represents earnings generated without constantly trading digital assets. It’s particularly appealing to investors seeking financial independence through blockchain technology and decentralized finance (DeFi) solutions.

What Is Crypto Passive Income?

Imagine earning money without staring at charts all day. That’s the beauty of crypto passive income – it works for you even when you’re not working. Think of it like owning property: your tenants pay rent while you focus on other things.

In the crypto world, you can “rent out” your digital coins through processes like staking and lending. Your assets generate rewards automatically, managed by blockchain smart contracts that eliminate the need for banks or middlemen. All you need is a crypto wallet and basic knowledge to get started.

DeFi platforms enhance these opportunities by offering interest on cryptocurrency loans or rewards for providing liquidity to trading pools – similar to high-yield savings accounts but with potentially greater returns.

Why Consider Crypto for Building Wealth?

Several compelling reasons make cryptocurrency an attractive passive income option:

- Impressive Returns: Traditional banks offer minimal interest (around 0.5%), while crypto staking and lending can deliver 5-100% annually depending on your chosen platform and tokens.

- Global Access: Anyone with internet access can participate, regardless of location or financial background.

- Complete Control: Your assets remain under your management without bank or government intermediaries.

- Growth Potential: Despite market volatility, the earning capabilities extend beyond basic interest to include governance participation and liquidity provision.

- Diverse Strategies: Options range from conservative approaches like staking established coins to more adventurous yield farming opportunities.

- Adaptable Investments: You can easily adjust your strategy as market conditions change, unlike many traditional investments.

The growing interest in crypto passive income is evident in the expanding DeFi ecosystem, which now holds over $200 billion in total locked value as of 2025.

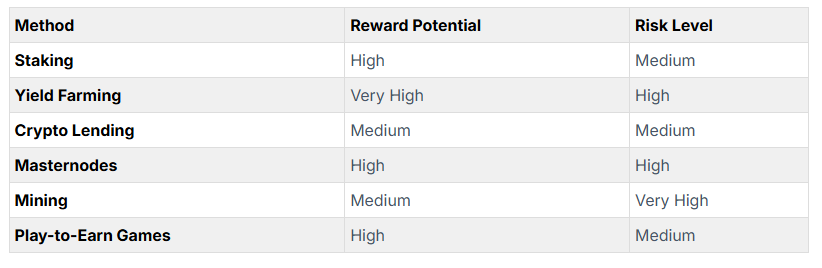

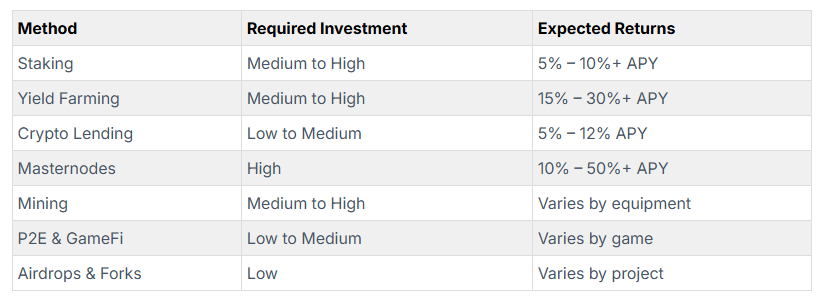

Understanding the Risk-Reward Balance

Potential Rewards

Popular staking options like Ethereum offer around 5-6% annual returns, while yield farming can deliver 50%+ APY depending on your chosen tokens and pools.

Risk Considerations

Market volatility represents the primary concern – cryptocurrency prices fluctuate dramatically, affecting your staking and lending returns. Platform security poses another significant risk, as demonstrated by the 2022 liquidity crises that affected Celsius Network and BlockFi users.

Higher returns typically accompany increased risk, making diversification essential. Never invest more than you can afford to lose, and thoroughly research platforms before committing your assets.

Many investors now combine multiple strategies (like staking and lending simultaneously) to spread risk while maximizing potential earnings.

Top Strategies for Crypto Passive Income

Staking Your Assets

Staking involves locking your cryptocurrency in a network to help verify transactions and strengthen blockchain security. In return, you receive rewards in additional coins.

Popular staking options include Ethereum, Cardano, and Solana, with annual returns typically ranging from 5-6%. You can stake directly through wallets like MetaMask or use exchanges like Kraken or Binance. Alternatively, you may delegate your staking to trusted validators for a small fee.

Yield Farming and Liquidity Provision

For higher returns, yield farming involves depositing cryptocurrency into decentralized exchanges like Uniswap or PancakeSwap. By providing liquidity to these platforms, you earn interest and sometimes additional token rewards.

While returns can reach 20-50%+ APY, be aware of impermanent loss – when your deposited tokens change value compared to when you first added them to the pool. Platforms like Yearn Finance automate the yield farming process, though returns remain unpredictable.

Lending Your Cryptocurrency

Crypto lending offers a more stable income stream. By lending your assets through platforms like BlockFi, Nexo, or Aave, you receive interest payments from borrowers.

You can choose centralized options like BlockFi (offering up to 8.6% APY on stablecoins) or decentralized alternatives like Aave for greater transparency. Always verify platform security before committing your funds.

Operating a Masternode

Masternodes represent a more advanced option requiring significant capital. These full network nodes verify transactions and perform essential blockchain functions in exchange for substantial rewards – sometimes reaching 50% APY.

The barrier to entry is high; for example, running a Dash masternode requires 1,000 DASH tokens. However, the potential returns (around 10% annually for Dash) make this an attractive option for serious investors.

Mining Cryptocurrency

Mining involves using specialized hardware to solve complex mathematical problems that secure blockchain networks. In return, you receive newly created cryptocurrency.

Bitcoin mining can be profitable with proper equipment and affordable electricity. Mining rigs range from a few hundred to several thousand dollars, with increasing difficulty as more miners join the network.

Cloud mining services like Genesis Mining offer an alternative for those who prefer not to purchase equipment, though fees reduce potential profits.

Play-to-Earn Gaming

Modern blockchain games like Axie Infinity and Decentraland allow players to earn cryptocurrency and NFTs through gameplay. While potentially profitable, these earnings depend heavily on token prices and community engagement.

Look for games with established development teams and active communities to maximize your chances of success.

Receiving Airdrops and Forks

Airdrops involve cryptocurrency projects giving free tokens to holders of certain coins, while forks occur when blockchains split into separate chains, creating duplicate tokens for existing holders.

While requiring minimal investment, be cautious of potential scams – verify project legitimacy before claiming free tokens.

Crypto Card Rewards

Cryptocurrency debit and credit cards offer token rewards on purchases. For example, the Crypto.com card provides up to 8% cashback in CRO tokens, while BlockFi’s Rewards Visa offers 1.5% Bitcoin rewards.

This approach turns everyday spending into passive income without additional effort.

Maximizing Your Crypto Income Strategy

Reinvestment for Compound Growth

Reinvesting your staking, lending, or farming rewards accelerates wealth building through compounding. For example, reinvesting 5% Ethereum staking rewards creates a 5.3% effective annual return after the first year, with increasing growth in subsequent years.

Look for platforms with automatic reinvestment features to simplify this process.

Platform Diversification for Risk Management

Spreading investments across multiple platforms protects against potential security breaches or market downturns. Consider staking on Kraken while simultaneously lending on Aave or yield farming on Uniswap.

Include stablecoins like USDC or DAI in your strategy to balance more volatile assets.

Regular Investment Monitoring

While crypto passive income requires less attention than active trading, regular monitoring ensures optimal performance. Check for changing reward rates, emerging security concerns, or new opportunities that might better serve your financial goals.

Set up alerts or use tracking applications like DeFi Saver to streamline this process.

Additional Optimization Tips

- Utilize DeFi platforms like Yearn Finance for auto-compounding and potentially higher returns

- Consider Layer 2 solutions like Optimism or Arbitrum to reduce Ethereum gas fees

- Stay informed about upcoming airdrops and forks to capture unexpected rewards

Common Mistakes to Avoid

Inadequate Platform Research

Never choose platforms based solely on advertised returns. Verify reputation, user reviews, and security measures before committing funds.

Neglecting Security Practices

Always enable two-factor authentication, protect private keys, and consider hardware wallets like Ledger or Trezor for long-term holdings.

Chasing Unrealistic Returns

Exercise caution with platforms promising extraordinary yields without clear explanations. Understand how rewards are generated and verify project stability.

Insufficient Diversification

Balance your portfolio across different assets, platforms, and strategies to protect against single-point failures.

Overlooking Fee Structures

Consider transaction costs, withdrawal fees, and gas expenses when calculating potential returns, especially on Ethereum-based platforms.

Ignoring Tax Obligations

Track your crypto earnings for tax purposes, as staking rewards, interest, and other passive income typically qualify as taxable income in most jurisdictions.

Failing to Plan an Exit Strategy

Establish clear profit-taking guidelines and loss limits before investing to remove emotional decision-making during market fluctuations.

See More :

Citigroup’s $81 Trillion Error: A Shocking Banking Blunder

Citigroup’s $81 Trillion Mistake – What Really Happened? How a $280 Transaction Became $81 Trillion Imagine checking your bank balance and finding…

Ethereum Fees Drop Below 1 Million: What This Means for Investors

Ethereum Fees Hit 5-Month Low: What’s Behind the Drop? Ethereum fees have decreased to under $1 million for the first time…

Brazil B3 Crypto Expansion: Bitcoin & Ethereum Futures

Introduction : Brazil B3 crypto expansion is gaining momentum as the country’s primary stock exchange, B3, announces new Bitcoin (BTC)…